Automated

Portfolio Investing

Choose from 50+ broad stock market indexes or build your own.

We handle the management—including tax loss harvesting—forjust $1/month.

SEC

Registered

Apex Clearing

Partner

Fiduciary

Why Choose Double?

No AUM Fees

To start investing in our over 50 indexes, all you pay is a simple $1 monthly fee. This is a game-changer in the investing world, putting more money back in your pocket.

With Direct Indexing

How do we do it? Instead of buying one share of a traditional ETF or mutual fund, we buy fractional shares of the individual stocks at the same weights. This allows your portfolio to track the underlying fund's exposure perfectly while offering you significant advantages.

And Tax Loss Harvesting

When you invest in individual stocks, you have more opportunities to sell losing positions to offset gains elsewhere, potentially reducing your tax bill.

Automated

Portfolio Investing

Choose from 50+ broad stock market indexes or build your own.

We handle the management—including tax loss harvesting—forjust $1/month.

Why Choose Double?

No AUM Fees

To start investing in our over 50 indexes, all you pay is a simple $1 monthly fee. This is a game-changer in the investing world, putting more money back in your pocket.

With Direct Indexing

How do we do it? Instead of buying one share of a traditional ETF or mutual fund, we buy fractional shares of the individual stocks at the same weights. This allows your portfolio to track the underlying fund's exposure perfectly while offering you significant advantages.

And Tax Loss Harvesting

When you invest in individual stocks, you have more opportunities to sell losing positions to offset gains elsewhere, potentially reducing your tax bill.

Indexes we have

for you

“What people have to say...

Nicholas T.

CEO

“I love the diversity of strategies I can invest in... And it made no sense for me to pay fees to an ETF when a robot can easily do it.”

Matt C.

Founder

“With automated features like rebalancing and tax loss harvesting, I don't have to worry about optimizing my portfolio manually.”

Patrick L.

Sr. Director Product Management

“I really like direct indexing with Double. It's simple to understand and provides me with something that I really can't get anywhere else.”

Arden A.

Enterprise Sales Leader

“Double has been very easy to use and I like the ability to direct index into both passive and more active strategies in one account.”

The testimonials above are by clients of Double Finance. No compensation was provided. These testimonials may not be representative of other clients' experience. Past performance is no guarantee of success. Double Finance is not aware of any material conflicts of interest of the individuals providing these statements.

Your money is secure

You always own your assets

Your funds are held in your name at Apex Clearing, one of the largest US Custodians holding over $114B in funds.

In the unlikely event that something happens to Double, your assets will be fully accessible.

We are a Fiduciary

Double is a Registered Investment Advisor, we are legally bound to do what is in your best interest.

Built with security in mind

We have strict measures in place to keep your data protected.

Sensitive information is encrypted and we offer 2-factor authentication for your protection.

SIPC Insured

Securities in your account are protected up to $500,000 through Apex Clearing. For details, visit www.sipc.org.

On top of this, Apex Clearing has purchased an additional insurance policy to supplement SIPC protection.

See how much you

could save on Fees

Money saved with Double

Advisors Effective Rate

Portfolio value with Double

Portfolio value with Advisor

Why Double is better than rest

Features | M1 | Wealthfront | Robinhood | Frec | |

|---|---|---|---|---|---|

Direct Index popular funds¹ | 20+ | 2 | 3 | ||

Tax aware rebalancing and automated tax loss harvesting² | |||||

Dollar Cost Average into and between strategies | |||||

Rebalance automatically to keep your exposure where you want it | Partially | ||||

Factor in taxes, trading costs, portfolio drift and factor models to determine optimal trades | Partially | ||||

Zero AUM fees |

Investing made simple

for you

Dollar Cost Average between strategies

Double Handles the Busy Work

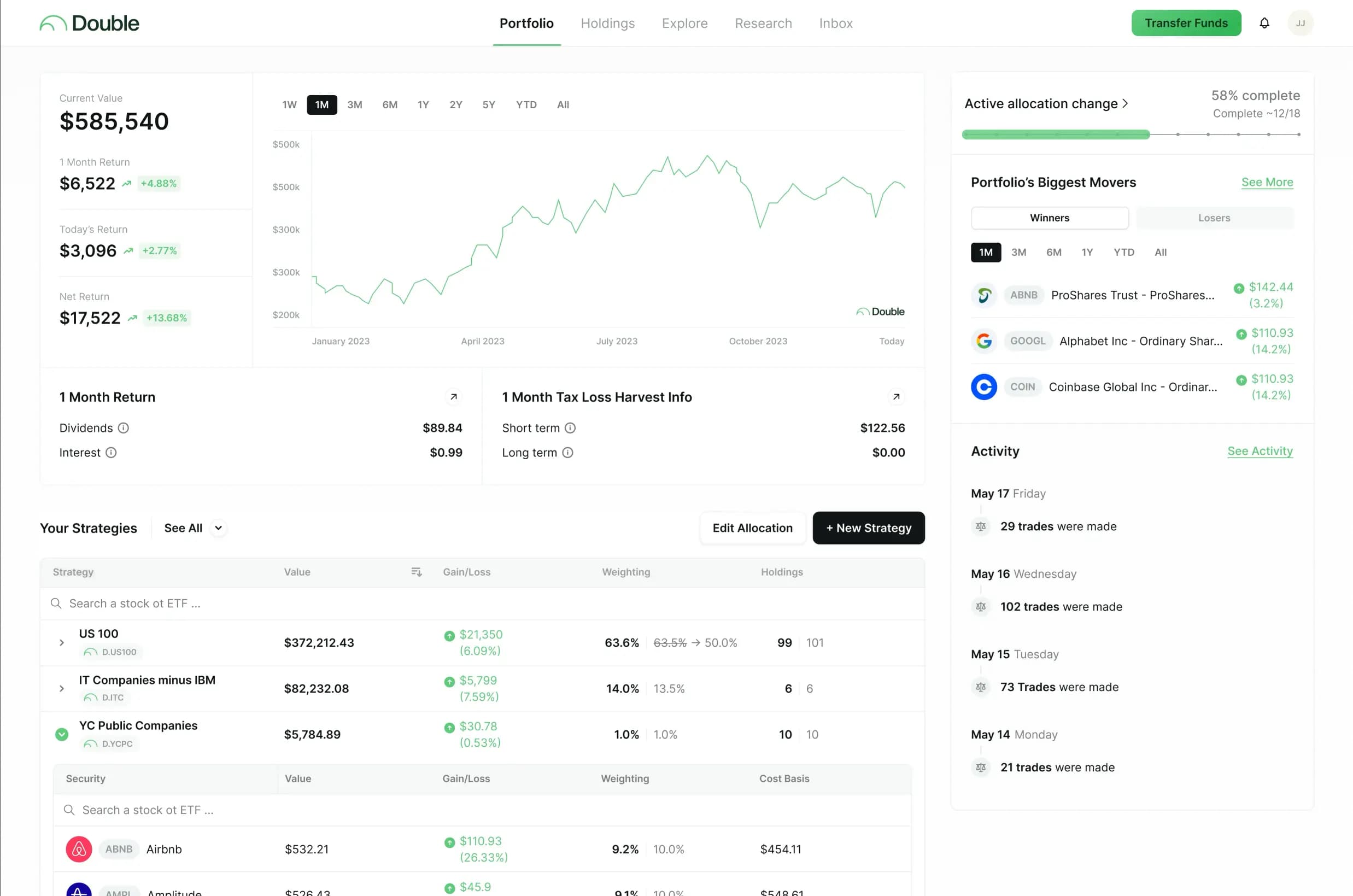

Double in action

Work for AAPL and want to exclude their stock?

Buy a direct indexed US Top 500 Portfolio, remove AAPL entirely and cut the rest of your tech exposure in half.

Did you know AI was going to be a big deal before everyone else?

Double makes it easy to tilt your portfolio towards your hunches. Pick a handful of stocks set to benefit from the Inflation Reduction Act, or some that target the booming AI and semiconductor industry, or shift your portfolio towards the explosive meme growth of Zyn.

Feeling confident in the overall market and ready to pile on the risk?

Follow Hedgefundie’s Adventure, which uses 3x leverage in a Stock and Bond ETF to try and increase returns. Or pick from our smart screens that target top growing companies or even all of the YC Public Companies.

Think we’re headed for a recession and want to take some chips off the table?

You can invest in a version of Ray Dalio’s All Weather Portfolio comprising 5 ETFs or John Bogle's Majesty of Simplicity and migrate between these Strategies and Bonds over time.

Build and backtest your own stock index!

Use our Stock and ETF Screeners to build your very own personalized portfolio